Table of Content

None of the blogs or other sources of information is to be considered as constituting a track record. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information.

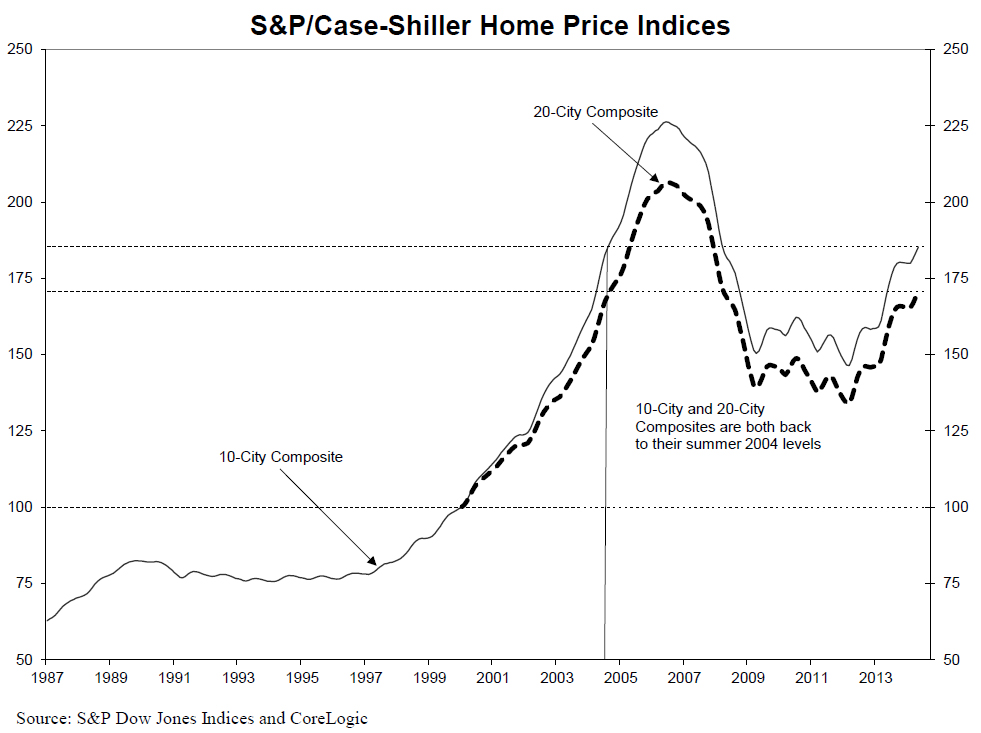

The S&L bubble was centered on commercial real estate but it also affected residential house values in some metros. For more, check out this post, What The 1990s Tell Us About The Next Housing Bust. In addition, the data is a 3-month moving average so that January data that comes out at the end of March is really the average for November-January. Or you could call it a 3-month moving average or a rolling quarterly index. This list includes investable products traded on certain exchanges currently linked to this selection of indices.

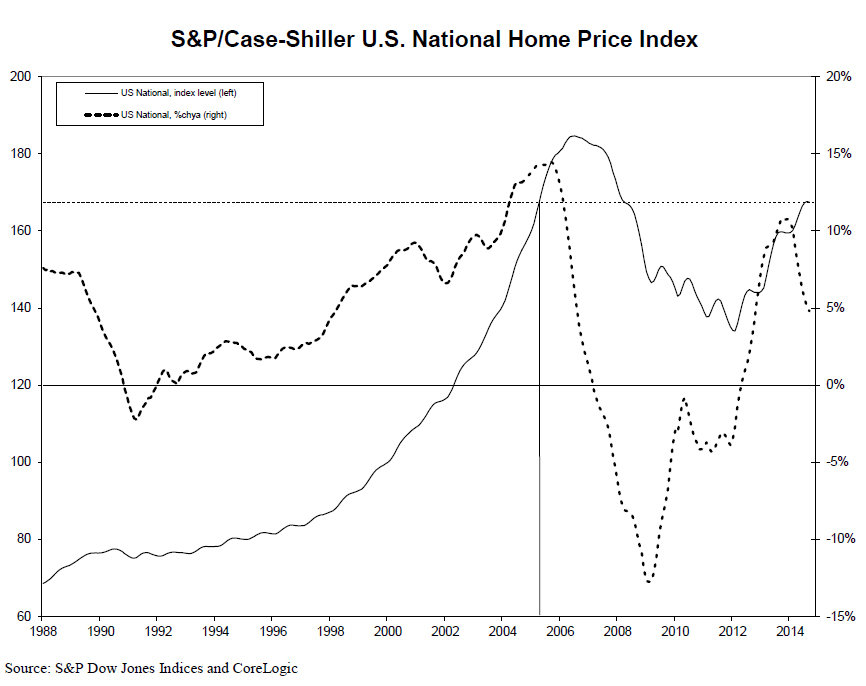

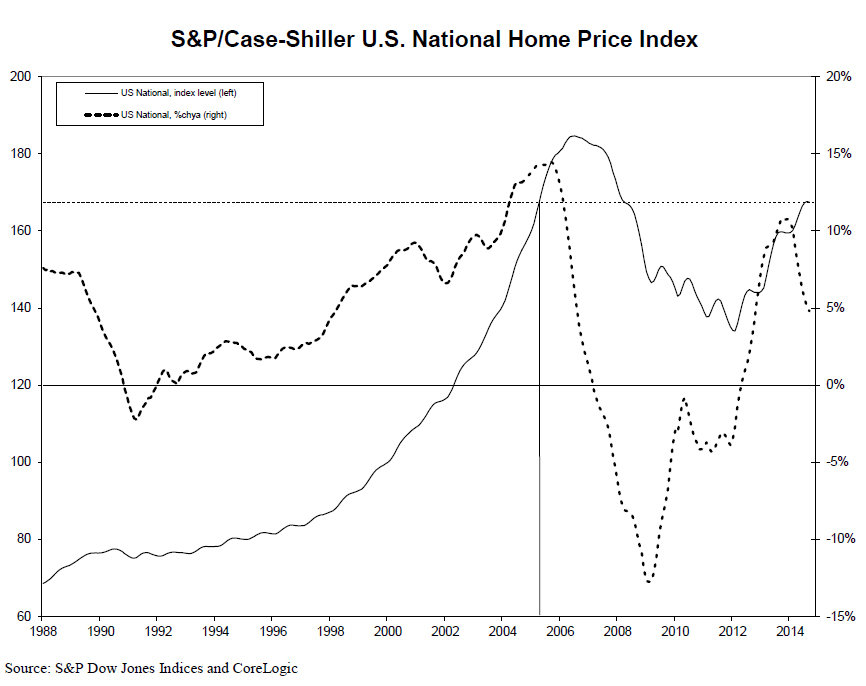

S&P/Case-Shiller U.S. National Home Price Index (CSUSHPINSA)

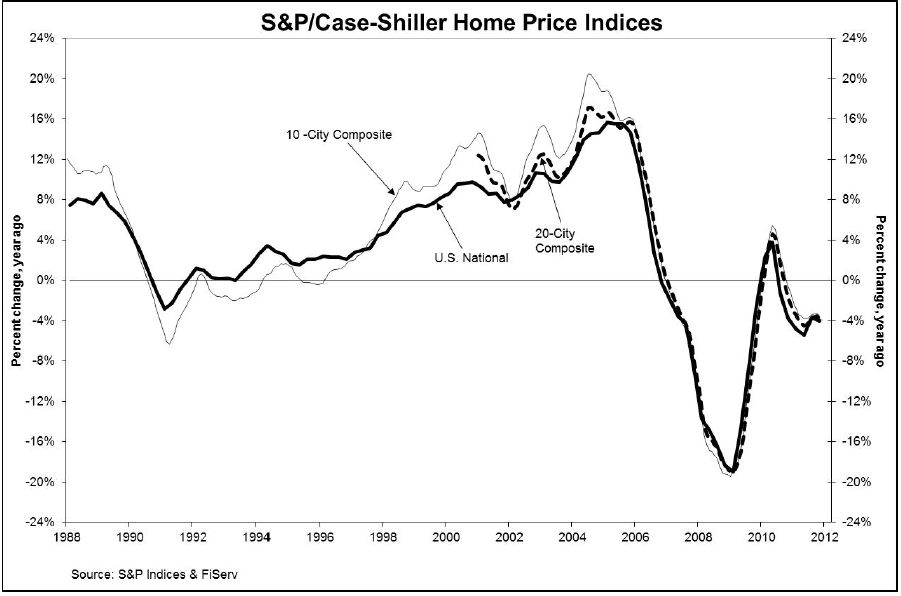

National Index posted a 0.9% month-over-month increase in December, while the 10-City and 20-City Composites posted increases of 1.0% and 1.1%, respectively. By providing my email, I consent to receiving investment related electronic messages from Stockhouse.

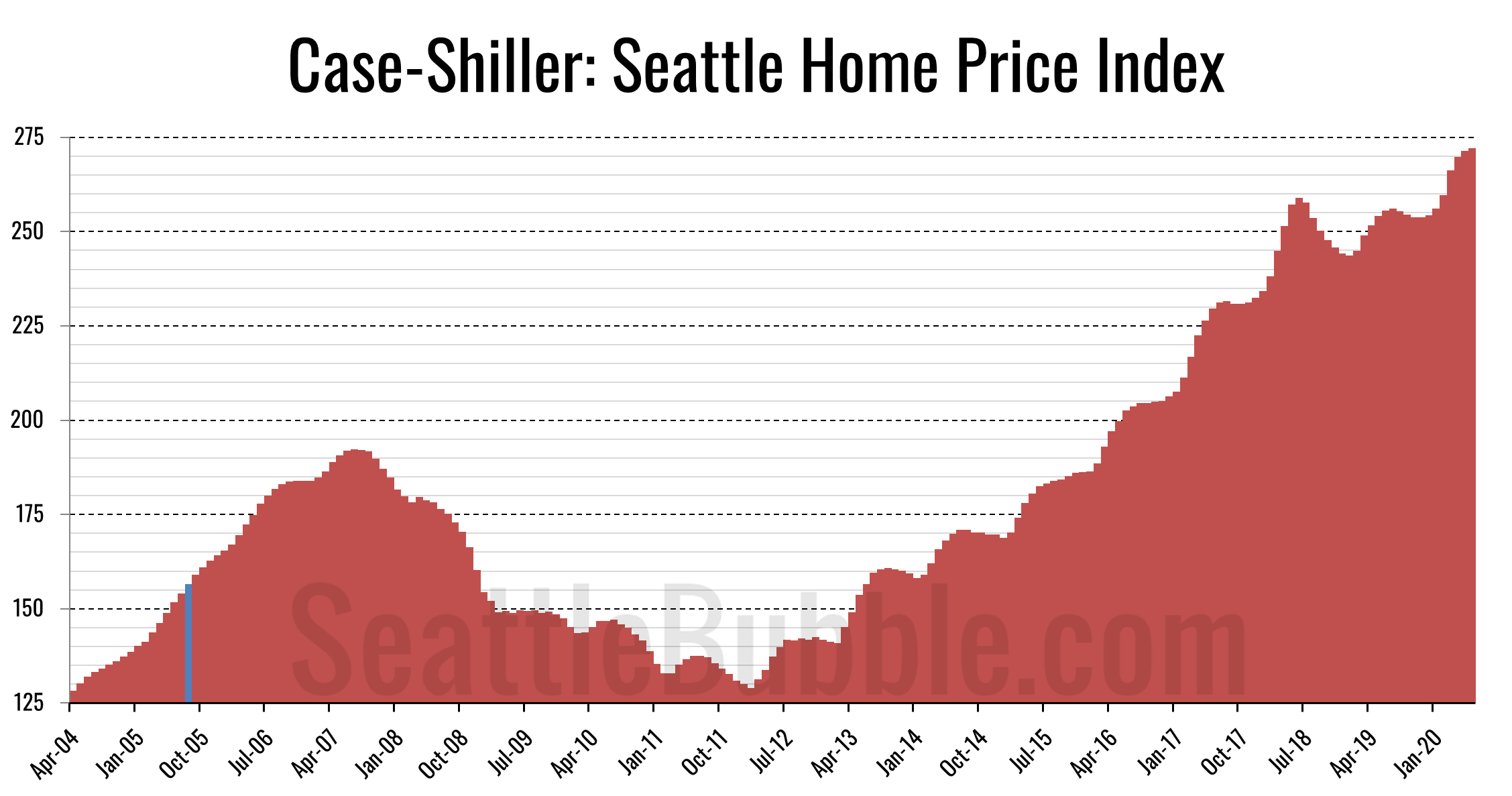

Real home prices were a bit higher using “CPI-U Less Shelter” as the deflator. For example, using the year 2000 as the baseline, the inflation-adjusted Case Shiller Index for the USA in November 2020 was 151 using CPI-U, and 159 using CPI-U Less Shelter. The idea is that if you’re taking out a mortgage to buy a house, the price of the house is mainly your monthly mortgage payment and the mortgage interest rate has a big impact on your monthly mortgage payment. That is, your mortgage interest rate has a big effect on the price – the monthly mortgage payment price – of your house. For fun, be sure and check out Denver and Portland house prices during the 1990s. House prices in New York and Boston peaked in the late 1980s and house prices in California and Washington DC peaked a bit later, right before the S&L recession started in 1990.

Housing market in Germany

Miami, Tampa, and Charlotte reported the highest year-over-year gains among the 20 cities in September. Miami led the way with a 24.6% year-over-year price increase, followed by Tampa in second with a 23.8% increase, and Charlotte in third with a 17.8% increase. All 20 cities reported lower price increases in the year ending September 2022 versus the year ending August 2022.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported an 18.8% annual gain in December, remaining the same from the previous month. The 10-City Composite annual increase came in at 17.0%, up from 16.9% in the previous month. The 20-City Composite posted an 18.6% year-over-year gain, up from 18.3% in the previous month. A broader measure of home prices, the national index, fell by a seasonally adjusted 1.1% in August from July. This is old data from September and pricing is a lagging indicator to begin with.

S&P CoreLogic Case-Shiller Index Continued To Decline In September

In states with higher property taxes, the percentage of the monthly payment going to principal and interest would be smaller. Since there’s a smaller percentage of principal and interest in each monthly mortgage payment, when mortgage rates fall, the overall monthly mortgage payment falls less. Additionally, the index assists economists in accurately seeing the effect of inflation on house prices and home sales. The S&P CoreLogic Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate nationally. For a list of additional indices, please refer to the S&P CoreLogic Case-Shiller Home Price Index Methodology. Here we look at per capita personal income in the Case-Shiller metros.

The S&P CoreLogic Case-Shiller 20-city home price index in the US increased only 16.1% year-on-year in July of 2022, decelerating for a third consecutive month, and below market forecasts of a 17% rise. It is also the smallest increase in home cost since April last year, with all 20 cities reporting deceleration, as the Fed continues to move interest rates up, making mortgage financing more expensive. Prices in Tampa (31.8%), Miami (31.7%), and Dallas (24.7%) rose the most while Minneapolis (9%), Washington (9.4%), and San Francisco (10.8%) recorded the smallest increases.

These indices are generated and published under agreements between S&P Dow Jones Indices and CoreLogic, Inc. Invented the first index in 1884, S&P DJI has been innovating and developing indices across the spectrum of asset classes helping to define the way investors measure and trade the markets. The S&P CoreLogic Case-Shiller Indices could be revised for the prior 24 months, based on the receipt of additional source data. Prices were strongest in the South (+25.7%) and Southeast (+25.6%), but every region continued to log impressive gains. National Index posted a month-over-month increase of 1.3%, and the 10-City and 20-City Composites posted increases of 1.4% and 1.5%, respectively.

All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date. Actual returns may differ significantly from, and be lower than, back-tested returns. Past performance is not an indication or guarantee of future results. This back-tested data may have been created using a “Backward Data Assumption”. For more information on “Backward Data Assumption” and back-testing in general, please see the Performance Disclosure. Case-Shiller numbers are 3-month moving averages so the January number is really the November-January average.

As with all such advisory services, past results are never a guarantee of future results. In January 2021, I switched from using CPI-U as the inflation deflator to using “CPI-U Less Shelter”. Since Case-Shiller itself directly measures home price inflation, it’s better to use a deflator that doesn’t also incorporate housing price changes.

Annual growth was slower in September than August in both the 20-city index (to 10.4% from 13.1%) and 10-city index (to 9.7% from 12.1%). The S&P CoreLogic Case-Shiller U.S. National Home Price Index® rose 10.6% year-over-year in September (non-seasonally adjusted), down from 13.0% in August. Nevertheless, you might be interested in looking at some income data to get a feel for the data. I wanted to see how the real estate booms developed from the very beginning so I moved the Case-Shiller baseline year back to 1995 from 2000.

On a monthly basis, home prices dropped 1.5 percent in September, a third consecutive month of decline, with prices falling across all cities. The S&P CoreLogic Case-Shiller 20-city home price index in the US increased 13.1% year-on-year in August of 2022, the least since February of 2021, and below forecasts of 14.4%. It marks a fourth consecutive month of slowing home price growth, compared to a downwardly revised 16% jump in the previous month. Meanwhile, the National Composite Index rose by 13% in August, down from 15.6% in July, the largest deceleration on record. Despite the ongoing deceleration, August’s housing prices remain well above year-ago levels in all 20 cities. Given the continuing prospects for a challenging macroeconomic environment, home prices may well continue to decelerate", says Craig J. Lazzara, Managing Director at S&P DJI.

Phoenix and Minneapolis data start in 1989, Seattle starts in 1990, Atlanta and Detroit start in 1991, and Dallas data only starts in 2000. More discussion of the Case-Shiller data near the bottom of this page. As soon as this statistic is updated, you will immediately be notified via e-mail. Access exclusive data and research, personalize your experience, and sign up to receive email updates.

However, the average and median numbers jump around a lot from month to month which makes it harder to see changes in price trends. Using an index of house prices instead of the actual dollar prices makes it easier to compare house price appreciation between the 20 cities. The Case-Shiller Home Price Index is the most accurate way to look at house price appreciation in a city, between cities, and nationally. The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index is a composite of single-family home price indices for the nine U.S.

Yes, the Case-Shiller index adjusts the house prices with the rising inflation. It records the actual selling price of the house or purchase price for an owner. This record helps eliminate people’s general perception or misinformation about the extremely high or rising prices of single-family houses or real estate properties. Thus, by recording the accurate increase or change in prices, the Case-Shiller index assists in determining actual cost and inflationary pressures leading to changes in the cost of a house. Additionally, the index allows analysts to study changing housing prices in different geographical areas of a country. The influencing factors include interest rates, changing incomes or revenues, population shifts, infrastructure, and other local market changes.